When you’re on multiple medications, insurance coverage can feel like a maze. Should you take two separate generic pills-or one combo pill? It sounds simple, but the answer can save you hundreds a year-or cost you more than you expect.

What’s the Difference Between a Generic Combination and Individual Generics?

A generic combination drug is a single pill that contains two or more active ingredients, each of which is also available as a standalone generic. For example, a blood pressure combo pill might include amlodipine and hydrochlorothiazide-both of which you can buy separately. The combo version is designed to simplify your routine: one pill instead of two. But here’s the catch: insurance plans don’t always treat them the same way. Some plans cover the combo pill at a low copay. Others cover the individual generics but not the combination. And in some cases, you’ll pay more for the combo pill-even though it’s made of the same generic ingredients.How Medicare and Private Plans Decide What to Cover

Medicare Part D and private insurers use something called a formulary-a list of drugs they cover and at what cost. Most plans divide drugs into tiers. Tier 1 is for preferred generics, with copays as low as $0 to $5. Tier 2 and above include brand-name drugs and non-preferred generics, with higher costs. In 2019, 84% of Medicare Part D plan-drug combinations covered only generic versions. That’s up from 69% in 2012. Insurers are pushing hard for generics because they cost 80-85% less than brand-name drugs. When six or more companies make the same generic, prices can drop by 95%. But when it comes to combination drugs, things get messy. Some formularies list the combo as a single item in Tier 1. Others only cover the individual components. And if the combo isn’t on the formulary, you might need a doctor to file a prior authorization request-just to get it covered.Why the Combo Pill Might Cost More Than Two Separate Pills

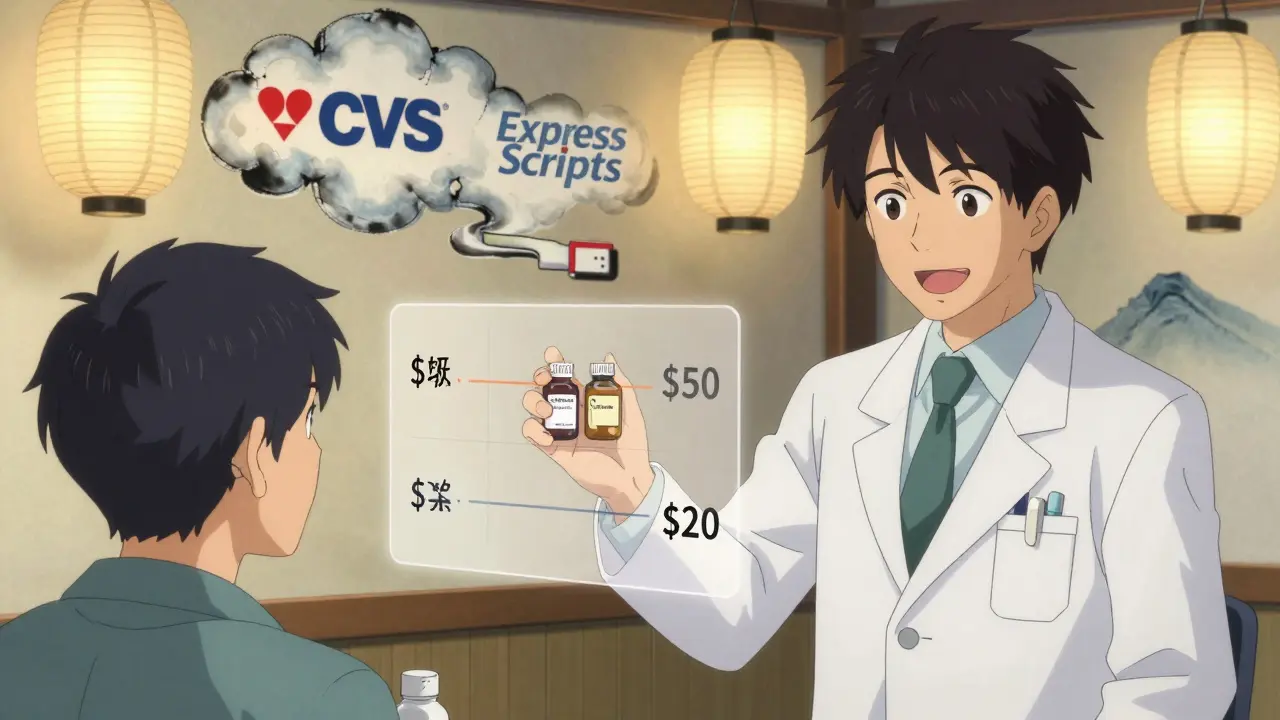

You’d think a combo pill would be cheaper than buying two generics. But sometimes, it’s not. Here’s how it works: if your plan covers amlodipine and hydrochlorothiazide separately at $10 each, but the combo pill is on Tier 2 with a $50 copay, you’re better off splitting them. You pay $20 total instead of $50. This isn’t rare. A 2023 Reddit user on r/Medicare shared: "My plan covers the individual generics for $10 each but the combination product would be $50. I had to ask my doctor to write two prescriptions to save money." Why does this happen? It often comes down to how the pharmacy benefit manager (PBM) negotiates prices. PBMs like CVS Caremark, Express Scripts, and OptumRx control 80% of the market. They may have a deal with a manufacturer for the individual generics, but not for the combo. Or, the combo might be made by a single manufacturer with no competition-making it a "single-source generic." These can cost nearly as much as brand-name drugs because there’s no price pressure.When the Combo Pill Saves You Money

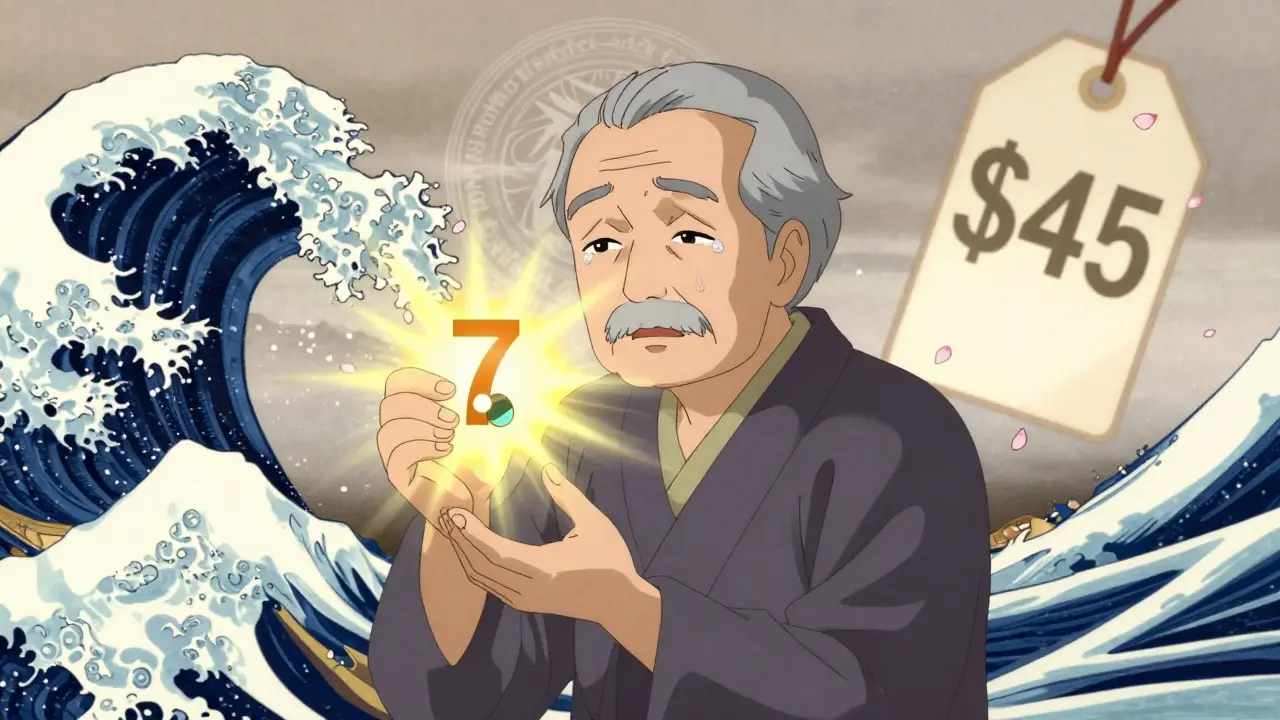

The opposite is also true. Many combo generics are placed in Tier 1, especially for chronic conditions like high blood pressure, diabetes, or high cholesterol. When a combo goes generic, out-of-pocket costs often drop dramatically. One Medicare beneficiary reported: "My blood pressure combo drug went generic. My monthly cost dropped from $45 to $7. No change in how I felt-just cheaper." This is common. In 2024, average generic copays ranged from $1 to $15. Brand-name drugs? $47 to $112. If your combo is covered at the lowest tier, it’s almost always the better deal.

How to Find Out What Your Plan Covers

You can’t guess. You have to check. Start with your plan’s formulary. Look up the exact drug names-both the combo and the individual components. Many plans hide this info behind logins or make it hard to search. AARP found that only 42% of Medicare Part D plans provide clear, easy-to-read formularies online. Use the Medicare Plan Finder (even if you’re not on Medicare-it shows how plans structure coverage). Enter the drug names. Compare the tier and copay for:- The combination product

- Each individual generic

- The total cost if you took them separately

What to Do If Your Combo Isn’t Covered

If your plan denies coverage for the combo pill-or forces you to try the individual generics first-you can appeal. Step 1: Ask your doctor to submit a "coverage determination" request. This is not a formality. It’s a formal appeal. For Medicare, it takes 72 hours for a standard request, 24 hours if you’re in urgent need. Step 2: Provide medical justification. Your doctor should explain why the combo is medically appropriate-for example, better adherence, fewer side effects, or simpler dosing. Step 3: If denied, escalate. You can request an external review. The Medicare Rights Center says 68% of beneficiaries need help understanding their coverage. You’re not alone.Big Changes in 2024: What’s New

Starting January 1, 2024, the Inflation Reduction Act made major changes:- Medicare Part D deductibles are gone.

- Out-of-pocket spending is capped at $2,000 per year.

- Copay assistance from drugmakers now counts toward your cap.

Real-World Tips to Save Money

- Always compare the combo vs. individual costs-even if the combo sounds "easier."

- Ask your pharmacist: "Is there a cheaper way to get these ingredients?" They often know hidden deals.

- Use GoodRx or SingleCare for cash prices. Sometimes paying cash is cheaper than insurance.

- If you’re on Medicare, check your plan’s formulary every year during open enrollment. Coverage changes.

- Don’t assume generics are always cheaper. Single-source generics can cost almost as much as brands.

Why This Matters Beyond the Cost

It’s not just about money. Taking multiple pills daily is harder. People forget. They stop. That’s why combo pills exist-to improve adherence. Studies show patients are 20-30% more likely to stick with their regimen when they take one pill instead of two. But if your insurance makes the combo unaffordable, you’re forced into a trade-off: pay more, or risk missing doses. That’s a real health risk. The system is designed to push generics-but not always the smartest ones. Sometimes, the cheapest option isn’t the one you’re told to take.What’s Next for Generic Combinations?

The FDA is speeding up approval of generic drugs through its GDUFA III program. More combo generics will hit the market by 2027. The Congressional Budget Office predicts generic use will rise from 90% to 93% of prescriptions by 2028. As more combos go generic, insurers will have to adapt. But until then, you need to be your own advocate. Know your plan. Know your drugs. And don’t accept the first answer you’re given.Can I ask my doctor to prescribe individual generics instead of a combo pill?

Yes, absolutely. Many doctors will switch you to separate generics if it saves you money. Just ask. You don’t need a special reason-cost is a valid medical concern. Your doctor can write two prescriptions, and your insurer must cover them if they’re on the formulary.

Why would my insurance cover the individual generics but not the combo?

It’s often about pricing deals between your insurer and drug manufacturers. The combo might be made by a single company with no competition, so it’s priced higher. Meanwhile, the individual ingredients might be made by multiple companies, driving prices down. Insurers favor the cheaper option-even if it means you take two pills.

Are generic combination drugs as safe as brand-name combos?

Yes. The FDA requires generic drugs to be identical in dosage, safety, strength, and how they work. A generic combo has the same active ingredients as the brand version. The only differences are in inactive ingredients like fillers or coatings-which rarely affect most people.

What if I can’t afford either the combo or the individual generics?

Check GoodRx, SingleCare, or NeedyMeds for discount cards. Some drugmakers offer patient assistance programs-even for generics. If you’re on Medicare, you may qualify for Extra Help, which lowers your costs further. Your pharmacist or local Area Agency on Aging can help you apply.

Do all insurance plans handle generic combinations the same way?

No. Medicare Part D plans follow similar rules, but private insurers vary widely. Some favor combos for adherence; others push individual generics to save money. Always check your specific plan’s formulary. Don’t assume what works for someone else will work for you.

So I just asked my pharmacist if I could split my combo pill into two separate generics and she laughed like I just asked if I could turn a Tesla into a horse.

Turns out, yeah, you can. And it saved me $38 a month. Pharma’s got us all confused like we’re playing Jenga with our prescriptions.

I appreciate the thorough breakdown, but I wish more patients knew to ask their doctors to prescribe individual generics. It’s not just about cost-it’s about control. I’ve seen people skip doses because they couldn’t afford the combo, and it’s heartbreaking. Always ask. Always compare. You’re not being difficult-you’re being smart.

OMG this is THE BEST GUIDE I’VE EVER SEEN ON THIS TOPIC. Like, I thought I was the only one who had to play detective with my insurance portal.

Turns out my combo pill was $52 and the two generics were $8 total. I felt like a genius. Also, GoodRx saved my life. I now treat my pharmacy like a game show: "Will the cash price beat the insurance price?!"

And yes, I high-fived my pharmacist. She didn’t even flinch.

This post is naive. You’re treating insurance like a grocery store where you can just pick the cheapest item. The system isn’t broken-it’s optimized. PBMs aren’t villains; they’re economic engineers. If you’re paying $10 for two generics, you’re benefiting from a subsidy created by people who pay $100 for the combo. You’re not saving money-you’re gaming a system built to protect the majority. Stop pretending you’re a hero.

Ugh. Another post pretending people are dumb for not knowing this. Newsflash: most patients don’t have time to become pharmaceutical analysts. They’re working two jobs, raising kids, and still managing their diabetes. The real problem isn’t the patient-it’s the fact that the system makes this a scavenger hunt. And yes, I’ve called my doctor 7 times this year just to get my blood pressure meds covered. Don’t tell me to "ask my pharmacist." She’s overworked and scared to speak up.

The underlying paradox here is that efficiency, in the form of the combination pill, is simultaneously a logistical simplification and an economic trap. The market structure does not reward the most therapeutic option-it rewards the most negotiable one. We have conflated cost with value, and in doing so, we have abstracted the patient into a variable in a spreadsheet. The real tragedy is not the copay-it’s the erosion of trust in care itself.

As someone from India, I can’t believe how lucky Americans are. Here, we pay 3x for the same generic because the system is so broken. My uncle took two separate pills for hypertension for 8 years because the combo wasn’t available. He had to drive 3 hours to the next city to get it. You people complain about $50? Try paying $150 for a single pill. And yes, I’ve seen people skip doses because they couldn’t afford it. You’re not poor-you’re just privileged enough to have a formulary to argue about.

Why are you even asking? The system is rigged. In India, we have 12 different generic manufacturers for the same drug. In the US, one company owns the combo and charges $50 because you’re too lazy to split pills. You’re not saving money-you’re enabling corporate greed. Also, your doctor doesn’t care. They get paid by volume, not outcomes. Stop being naive.

Let me guess-you think the FDA cares about your wallet. They don’t. They care about approval timelines. PBMs care about margins. Your doctor cares about avoiding paperwork. And you? You care about not dying. The entire system is a theater of the absurd. You’re not a patient. You’re a revenue stream with a pulse. Stop asking questions. Start accepting that healthcare is a business disguised as a moral imperative.

The structural inefficiencies within pharmaceutical formularies necessitate a proactive, informed approach to medication management. One must engage in comparative cost analysis between therapeutic alternatives, leveraging both public and private resources to ensure optimal outcomes. The Inflation Reduction Act represents a meaningful, albeit incremental, step toward mitigating financial toxicity. It is imperative that patients remain vigilant and collaborate with clinical teams to navigate these complexities with precision and diligence.

Oh sweet mercy. So the system is designed to make you take two pills so your insurance company can save $30... and you’re supposed to be grateful?

Next they’ll charge you extra for breathing. "Sorry, ma’am, your oxygen is on Tier 3. Would you like to upgrade to the combo inhaler?"

God help us all.

The most fascinating thing about this whole mess is how the solution is obvious-split the pills-but the system makes it feel like rebellion. It’s not about drugs. It’s about power. Who gets to decide what’s "convenient"? Who profits when you’re confused? The answer isn’t in the formulary. It’s in the boardroom.

You think this is bad? Wait till you see what happens when the FDA approves a new combo in 2027. The PBMs will immediately slap a 300% markup on it because they "negotiated exclusivity." Meanwhile, your individual generics will be phased out because "the market has evolved." You’ll be forced into the combo. You’ll pay more. You’ll be told it’s "for your own good." And you’ll believe them because you’ve been conditioned to trust authority. This isn’t healthcare. It’s psychological manipulation wrapped in a prescription bottle. I’ve seen this happen in my village in Punjab. The same playbook. Same lies. Different country, same scam.