Buying prescription drugs without insurance sounds like a dream-no copays, no formulary restrictions, just a price tag and a click. But is it really cheaper? For some meds, yes. For others, you could end up paying more than if you used your insurance. The truth isn’t simple. Direct-to-consumer (DTC) pharmacies like Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, Costco, Walmart, and Health Warehouse promise transparency and low prices. But they don’t always deliver savings for everyone. Here’s what actually happens when you skip insurance and pay cash.

What Are DTC Pharmacies, Really?

DTC pharmacies sell medications directly to you without going through your insurance or a pharmacy benefit manager (PBM). They cut out the middlemen-companies that negotiate drug prices behind closed doors and often inflate costs for consumers. Instead, these pharmacies use a simple model: cost + markup. Mark Cuban’s company, for example, adds just 15% to the wholesale price of each drug. Amazon and Costco do something similar. No rebates, no secret discounts, no confusing tiers. You see the price. You pay it. No surprises.

This model works best for expensive generic drugs-medications that cost hundreds of dollars a month under traditional insurance plans. For example, drugs like mycophenolate (used after organ transplants) or lumacaftor/ivacaftor (for cystic fibrosis) often have list prices over $1,000. But with DTC pharmacies, you might pay under $200. That’s where the biggest savings show up.

Where You Save the Most: Expensive Generics

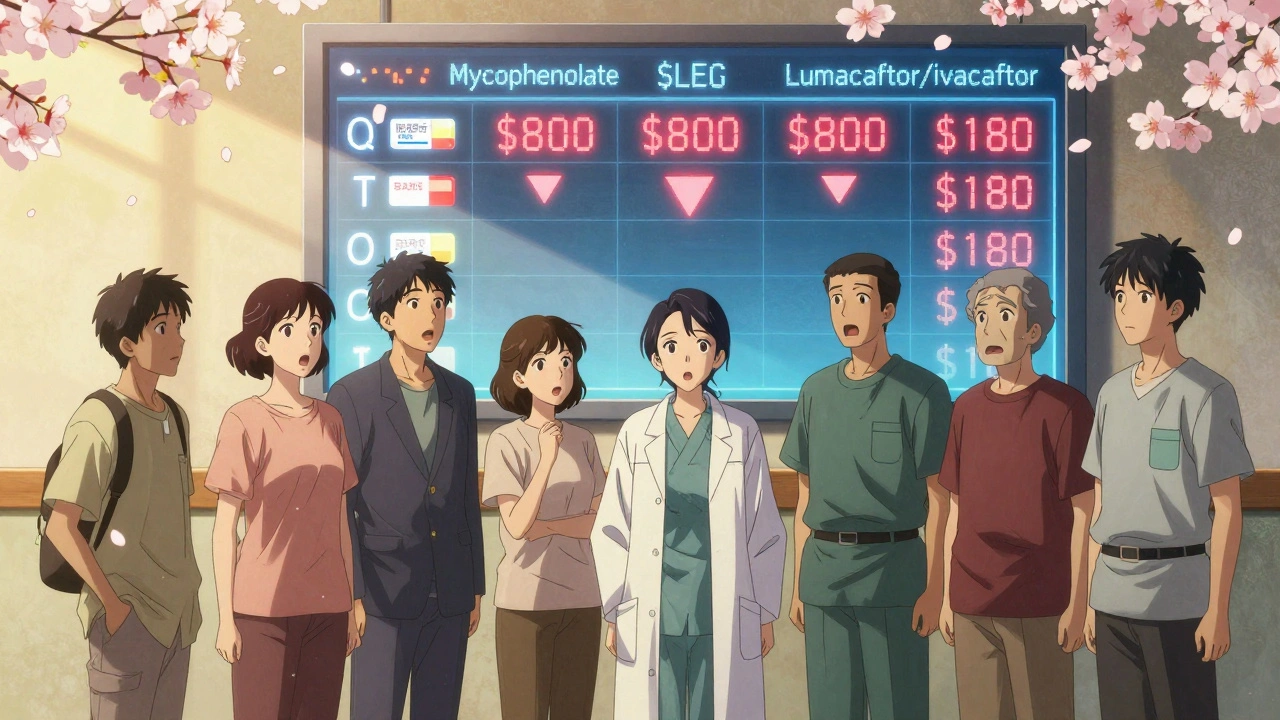

A 2024 study in the Journal of General Internal Medicine looked at 100 of the most expensive and most common generic drugs covered by Medicare Part D. For the top 50 most costly generics, DTC pharmacies saved patients an average of $231 per prescription compared to retail prices listed on GoodRx. That’s a 76% drop in out-of-pocket cost. Some drugs dropped from $800 to $180. For people without insurance-or those with high-deductible plans-this is life-changing money.

But not all DTC pharmacies are the same. The same study found that for these expensive generics:

- Amazon Pharmacy had the lowest price on 47% of them

- Mark Cuban Cost Plus Drug Company had the lowest on 26%

- Costco and Health Warehouse split the rest

So if you’re taking a high-cost generic, you can’t just pick one site and call it quits. You have to check all of them. And you have to check every time you refill. Prices change weekly.

Where You Might Lose: Common Generics

Now, here’s the twist. For common generics-like metformin, lisinopril, or atorvastatin-the savings aren’t nearly as dramatic. The same study found median savings of just $19 per prescription. That’s still a 75% drop from retail, but $19 isn’t enough to justify the time it takes to compare prices across five different websites.

And here’s the catch: for these everyday drugs, your insurance might already be giving you the lowest price. Many plans have $5 or $10 copays for generics. If your insurance covers it, you might pay less than you would on Amazon or Walmart-even if you’re paying cash there. Costco, for example, sells 90% of commonly prescribed generics for under $20 for a 30-day supply. But if your insurance copay is $5, you’re still better off using it.

The Big Problem: Missing Drugs

One-fifth of the most expensive generic drugs aren’t available at any major DTC pharmacy. That’s not a small gap. It’s a dealbreaker for people with rare conditions. For example, if you need cladribine (for multiple sclerosis) or elivaldogene autotemcel (for a rare blood disorder), you won’t find it on Amazon, Mark Cuban’s site, or even Costco. These drugs are still locked behind insurance networks and specialty pharmacies.

A 2023 study from CVS Health looked at 79 neurological generics. Mark Cuban’s pharmacy carried only 33 of them. And of those 33, only two were cheaper than what insured patients paid out-of-pocket through their PBM. That means for a large group of patients-especially those with chronic neurological conditions-DTC pharmacies don’t offer savings. They offer frustration.

Insurance Isn’t Always the Enemy

It’s easy to think insurance is the problem. But the real problem is the PBM system-those middlemen who negotiate prices, hide rebates, and often charge you more than the actual cost of the drug. DTC pharmacies bypass that system. But they don’t replace it for everyone.

Here’s the reality: if you have good insurance with low copays, you’re probably already getting the best deal on common generics. Switching to DTC might save you a few bucks, but it won’t save you much-and you’ll lose the convenience of automatic refills, mail delivery, and pharmacy counseling.

On the other hand, if you’re uninsured, underinsured, or stuck with a high-deductible plan, DTC pharmacies can be a lifeline. For expensive drugs, they’re often the only affordable option.

How to Actually Save Money

You can’t just pick one DTC pharmacy and assume it’s the best. You have to shop around-every time. Here’s how to do it right:

- Know your drug. Write down the exact name, strength, and quantity (e.g., “metformin 500mg, 90 tablets”).

- Check at least four DTC pharmacies: Amazon, Mark Cuban Cost Plus Drug Company, Costco, and Walmart. Don’t forget Health Warehouse.

- Compare those prices to your insurance copay. Call your pharmacy or log into your plan’s portal. Sometimes your copay is lower than the cash price.

- Use GoodRx as a baseline-but don’t trust it blindly. It shows retail prices, not your insurance rate.

- Set a reminder to check again every 3 months. Prices change often.

There’s no app that does this for you. No tool that shows you the lowest price across all pharmacies in real time. That’s the biggest barrier. You have to do the work.

Who Should Use DTC Pharmacies?

Not everyone should use them. Here’s who benefits most:

- Uninsured people taking expensive generics

- People on high-deductible plans who haven’t met their deductible yet

- Seniors on Medicare Part D who hit the coverage gap (donut hole)

- People taking one or two high-cost drugs and willing to shop around

Here’s who should stick with insurance:

- People on low-cost plans with $5-$10 generic copays

- People taking multiple medications-the time to compare prices adds up

- People on specialty drugs not available on DTC sites

- Anyone who values convenience over a few extra dollars

The Bottom Line

DTC pharmacies aren’t a magic fix. They’re a tool. And like any tool, they work well for some jobs and poorly for others. If you’re paying hundreds a month for a single drug and have no insurance, they can save you thousands. If you’re paying $10 for your blood pressure pill and your insurance covers it, switching won’t help-and might even cost you more.

The real win isn’t choosing between insurance and DTC. It’s knowing which option is cheapest for your specific drugs, right now. That takes effort. But for the right people, it’s worth it.

Are DTC pharmacies cheaper than insurance?

It depends. For expensive generic drugs, yes-often by hundreds of dollars. For common generics like metformin or lisinopril, your insurance copay might be lower than the cash price at DTC pharmacies. Always compare your insurance copay to the cash price on sites like Amazon, Costco, and Mark Cuban Cost Plus Drug Company before deciding.

Which DTC pharmacy is the cheapest?

There’s no single winner. For expensive generics, Amazon Pharmacy is cheapest most often (47% of the time), followed by Mark Cuban Cost Plus Drug Company (26%). For common generics, Costco often has the lowest price. But prices change weekly, so you must check multiple sites for each drug every time you refill.

Can I use DTC pharmacies if I have Medicare?

Yes. Medicare Part D doesn’t cover purchases from DTC pharmacies, but that’s not always a bad thing. If you’re in the coverage gap (donut hole), paying cash through a DTC pharmacy can be cheaper than paying your plan’s coinsurance rate. Many seniors use this strategy to save money on expensive generics.

Why don’t DTC pharmacies carry all drugs?

DTC pharmacies focus on high-volume, high-demand generics. Many expensive or specialty drugs-like those for rare diseases or neurological conditions-are not stocked because they’re too costly to keep in inventory or have low demand. One-fifth of the most expensive generics aren’t available anywhere on DTC platforms.

Is it safe to buy meds from DTC pharmacies?

Yes-if you stick to major, well-known companies like Amazon Pharmacy, Costco, Walmart, or Mark Cuban Cost Plus Drug Company. These are licensed, regulated, and source drugs from approved U.S. suppliers. Avoid random websites that look like pharmacies but aren’t verified. Look for the VIPPS seal (Verified Internet Pharmacy Practice Sites) to confirm legitimacy.

Should I stop using my insurance and switch to DTC?

No-not unless you’ve checked every drug you take. For most people on insurance, especially with low copays, sticking with your plan is simpler and often cheaper. DTC pharmacies are best used as a backup for specific high-cost drugs your insurance doesn’t cover well. Don’t abandon your insurance unless you’re certain you’ll save money across your entire medication list.

Been using Cost Plus for my dad’s transplant meds. Saved us $1,200/month. No drama. Just pay and get it. Insurance? They made us jump through hoops just to get the same pill.

Of course the system wants you to think this is a choice. It’s not. It’s survival. They rigged the game so you need to be a detective just to afford your own life.

Let’s be real: the PBM-industrial complex is a cancer on American healthcare. These DTC pharmacies? They’re not a solution-they’re a symptom. The real problem is that we’ve outsourced morality to shareholders and call it ‘efficiency.’ We’ve turned medicine into a commodity, and now we’re surprised people are dying because they can’t afford the markup on a 50-year-old generic? This isn’t capitalism-it’s extortion dressed in a lab coat.

As a licensed pharmacist with 22 years in the industry, I must emphasize that the assertion that DTC pharmacies are universally cheaper is statistically misleading. The study cited fails to account for bulk purchasing discounts negotiated by insurers, which often reduce out-of-pocket costs below cash prices for multi-drug regimens. Furthermore, the absence of clinical consultation and medication reconciliation services at DTC platforms introduces significant patient safety risks. I strongly advise against abandoning insurance-based pharmacy services without professional oversight.

I used to be the person who just took whatever the pharmacy said. Then my kid got diagnosed with a rare condition and the insurance refused to cover the only drug that worked. I spent three weeks comparing prices across five sites, calling every pharmacy, crying in the car after finding out Costco had it for $170 instead of $900. That’s not saving money. That’s fighting for your child’s life. If you think this is just about convenience-you haven’t lived it.

you dont need to do all that work. just use goodrx + your insurance. i thought i was being smart switching to amazon for my blood pressure med… turned out my copay was $3. i paid $18. facepalm. now i just check my app before i refill. duh.

Did you know Amazon Pharmacy is owned by a company that also owns facial recognition tech used by ICE? And Walmart? They’re the biggest supplier of private prisons. You think you’re saving money on your meds but you’re funding the machine that locks people up for being poor. Wake up.

There is no such thing as 'free market' in pharmaceuticals. The entire system is engineered to extract wealth from the sick. DTC pharmacies are merely the latest iteration of predatory capitalism-offering false hope while maintaining the same exploitative structure. The only real reform is universal healthcare, not shopping around like a bargain hunter at a flea market.

It’s interesting how we’ve turned something as basic as access to medicine into a competitive sport. We’re not supposed to have to compare prices like we’re haggling over a used car. But here we are. Maybe the real question isn’t which pharmacy is cheapest-but why we’re forced to choose at all.

The structural inefficiencies in pharmaceutical distribution are a direct result of deregulation and the commodification of health. The emergence of DTC pharmacies, while pragmatically beneficial for some, reflects a deeper societal failure: the absence of a publicly funded, universally accessible pharmacopeia. The psychological burden of price-checking every refill is a form of medical trauma, particularly for elderly and disabled populations who lack digital literacy or the cognitive bandwidth to navigate this labyrinth.

For anyone feeling overwhelmed by this-start small. Pick one drug you take every month. Check it once. Just once. If you save $10, that’s $120 a year. That’s a weekend trip. A new pair of shoes. A night out. You don’t need to be a superhero. Just a little bit more aware. You’ve got this.

It’s disgraceful that Americans must become pharmacists, economists, and data analysts just to afford basic medicine. This is not freedom. This is a system designed to break people. And yet, we’re told to be grateful for crumbs. I refuse to be grateful for being allowed to live.

OMG I just found out my insulin is $40 on Cost Plus!! I’ve been paying $300 with insurance 😭 thank you for this post!!

Why are we even talking about this? It’s simple: if you’re not a citizen, you don’t deserve to live. The government should shut down these DTC sites and force everyone to use insurance like normal people. This is why America is falling apart-too many people think they’re entitled to cheap drugs.

They say transparency is the solution. But transparency without regulation is just another form of manipulation. If you’re going to show me the price, then show me the cost of production. Show me the R&D. Show me the profit margin. Don’t give me a number and call it fair. That’s not transparency-that’s theater.